Future Prospects of Silicon Carbide in the Semiconductor Industry

Understanding Silicon Carbide and its Significance in the Semiconductor Sphere

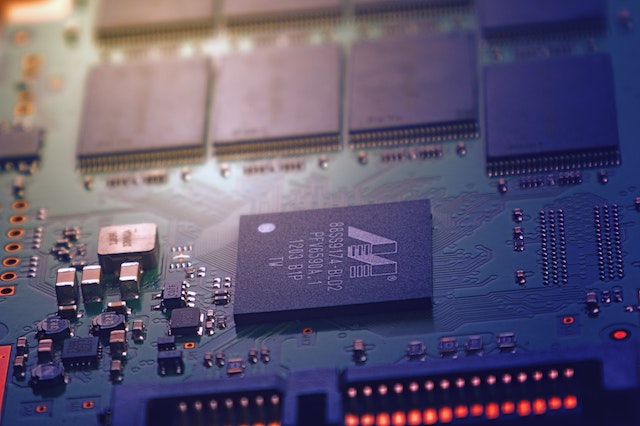

The fundamental substance in the semiconductor sector, Silicon Carbide (SiC), becomes crucial due to its exceptional characteristics. It propels progressions in power semiconductors by surpassing the capabilities of conventional silicon-based appliances. The high voltage and temperature operation capacity make SiC a material par excellence for power semiconductors that are witnessing growing usage across diverse sectors including automotive, renewable energy, and telecommunications.

An examination of market trends reveals an impressive growth trajectory for the global Silicon Carbide semiconductor sphere. As per data analysis trends, back in 2022, the SiC power semiconductor market was pegged at USD 395 million but is on course to escalate to USD 1,109 million by 2030. This dramatic expansion owes much to a robust Compound Annual Growth Rate (CAGR) exceeding 17%, primarily driven by soaring demand for advanced power devices dovetailed with technological leaps in wafer size.

But SiC Power Semiconductors’ influence isn’t confined only to boosting performance; they also play a significant part in curtailing carbon emissions thus making them green alternatives. Increasing investment into R&D activities related to these SiC semiconductors from various companies indicates their potential role as game changers within the future panorama of the global Semiconductor Market owing to their enhanced efficiency and dependability features.

The Current Position and Reach of Silicon Carbide in the Global Semiconductor Market

The semiconductor landscape is witnessing a remarkable increase in the prominence of Silicon Carbide (SiC), largely driven by an escalating demand for power semiconductors and SiC-specific ones. According to market studies conducted recently, projections indicate that the global silicon carbide semiconductor sphere may hit USD 1,812.7 million come 2023, boasting a CAGR of 18.1%. This impressive growth rate can be traced back to a buoyant upswing in sectors such as automotive and electric vehicle manufacturing that necessitate high voltage devices. The deployment of SiC materials brings about superior efficiency owing to their capacity to operate at elevated frequencies and temperatures while simultaneously downsizing system size.

Fast forward into year 2022, it’s anticipated there’ll be sturdy growth within the SiC power module arena due to advancements made around discrete semiconductor devices. One major player propelling this momentum is STMicroelectronics which has been pivotal in introducing innovations within the Silicon Carbide domain. However, one cannot overlook how COVID-19 left its mark on wafer production worldwide causing numerous firms including ROHM and Infineon plus STMicroelectronics itself to forge strategic alliances aimed at ensuring supply chain stability.

Peering into future towards 2030 horizon, industry experts foresee substantial expansion happening within the semiconductor marketplace predominantly powered by ongoing enhancements revolving around SiC power semiconductors technology. These improvements not only add significantly towards boosting energy efficiency but also hold essential role in addressing burgeoning demands from diverse sectors like renewable energies or e-mobility systems thereby further accelerating market expansion.

The Role of SiC Power in the Expansion of the Semiconductor Market by 2030

In a world increasingly enamored with Silicon Carbide (SiC) power semiconductors, their rising prominence in the global market is hardly surprising. The superiority of SiC devices over traditional silicon-based counterparts hinges on their wide bandgap, which facilitates operation under escalated electric fields and temperatures while curtailing energy consumption drastically. Consequently, sectors like consumer electronics, automotive and power electronics are experiencing an influx of silicon carbide adoption. Market analysis suggests that a significant growth spurt awaits the SiC power semiconductor arena within the forecast period.

To comprehend this trend more clearly, consider this: In 2020 alone, the global Silicon Carbide (SiC) market was pegged at USD 2.52 billion – fast forward to 2030 predictions show it skyrocketing to USD 7.93 billion! This potential surge in growth can be traced back to two primary catalysts: heightened demand for larger SiC wafers from Electric Vehicle manufacturers; and fine-tuning of supply chain operations leading to enhanced manufacturing processes for materials such as silicon carbide wafers.

Yet even as we paint this rosy picture of high-octane possibilities for Silicon Carbide devices’ future trajectory, one cannot overlook certain roadblocks lying ahead. High production costs coupled with COVID-19-induced disruptions in international supply chains could negatively impact delivery schedules thus slowing down progress significantly.

However daunting these challenges may appear though, experts remain bullish about ongoing research into cost-effective production methods for bigger SiC wafers combined with ever-increasing global energy demands providing enough fuel to keep driving both adoption rates as well as overall market expansion consistently over time.

Analyzing the Growth of SiC Semiconductors and Power Semiconductors in the Market

In the realm of semiconductors, an intriguing shift is discernible as Silicon Carbide (SiC) begins to infiltrate power electronics at a remarkable pace. The burgeoning attraction towards SiC from semiconductor manufacturers can be attributed to its superior attributes such as wider band gap, potent breakdown electric field and commendable power management skills that outshine traditional silicon semiconductors. Projections from industry insiders suggest a considerable upsurge in the growth trajectory of the SiC power electronics market during the prognosticated era.

A notable force propelling this upward trend are motor drives. Industrial motor drives are increasingly adopting SiC power modules due to their proficiency in harnessing high-power levels whilst ensuring minimal power consumption compared to conventional devices. This assimilation of sic power electronics within motor drives and other singular devices like MOSFETs underscores how this particular market segment is evolving swiftly. In addition, advancements in SiC material production hint at a possible decrease in cost for these components, fuelling further adoption across multiple sectors.

Regarding revenue stream generation, it’s significant that 2021 saw record-breaking revenues exceeding billions; not only underscoring how rapidly this sector has grown but also offering insight into future prospects. Furthermore, recent research into semiconductor markets indicates dominant segmentation favouring electric and hybrid vehicles (EV/HEV), largely due to their demand for efficient energy conversion systems where SIC takes centre stage.

Another wide bandgap contender potentially rivaling SIC could be GaN as per industry experts’ predictions yet current trends imply otherwise.

This panorama suggests an optimistic outlook for SIC-based semiconductors emphasizing why there’s anticipation of sustained momentum even beyond 2030 thus substantiating both immediate projections and long-term aspirations concerning its growth path.

Comments are closed.